A mutual fund is a type of investment fund that pools money from multiple investors and invests it in a variety of stocks, bonds, and other securities. Mutual funds are often used by investors who want to diversify their portfolios and reduce risk.

Mutual funds are typically managed by a professional investment manager who is responsible for selecting the investments that the fund will hold. The manager’s goal is to generate returns for the fund’s investors that are in excess of the returns of the market as a whole.

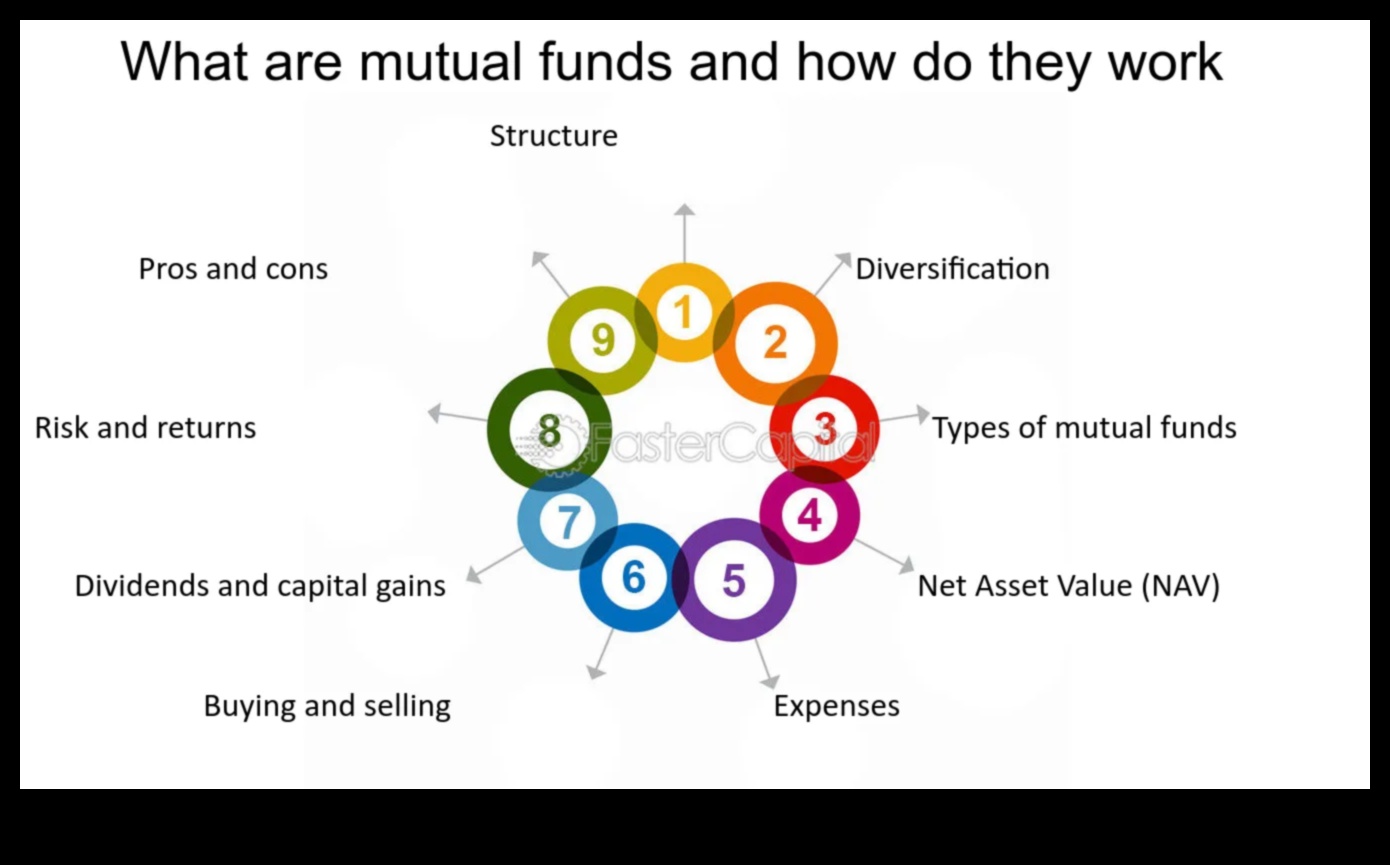

There are many different types of mutual funds, each with its own unique investment objectives and strategies. Some of the most common types of mutual funds include:

- Stock funds

- Bond funds

- Money market funds

- Index funds

- Target-date funds

The type of mutual fund that is right for you will depend on your individual investment goals and risk tolerance. If you are not sure which type of mutual fund is right for you, it is important to consult with a financial advisor.

Investing in mutual funds can be a great way to build wealth over time. However, it is important to remember that there is no guarantee of returns and that mutual funds can lose value. Before investing in a mutual fund, it is important to understand the risks involved and to make sure that the fund is aligned with your investment goals.

| Feature | Description |

|---|---|

| Mutual fund | A mutual fund is a type of investment vehicle that pools money from multiple investors and invests it in a diversified portfolio of stocks, bonds, and other securities. |

| Investment | Mutual funds are a popular investment option for individuals of all ages and income levels. They offer a number of benefits, including diversification, professional management, and low fees. |

| Stock market | Mutual funds invest in stocks, which are shares of ownership in a company. The value of a stock can go up or down, depending on the performance of the company. |

| Diversification | Mutual funds are diversified, which means that they invest in a variety of stocks, bonds, and other securities. This helps to reduce the risk of loss if one investment performs poorly. |

| Risk management | Mutual funds can be used to manage risk by investing in different asset classes, such as stocks, bonds, and cash. This helps to ensure that your portfolio is not too heavily invested in any one asset class. |

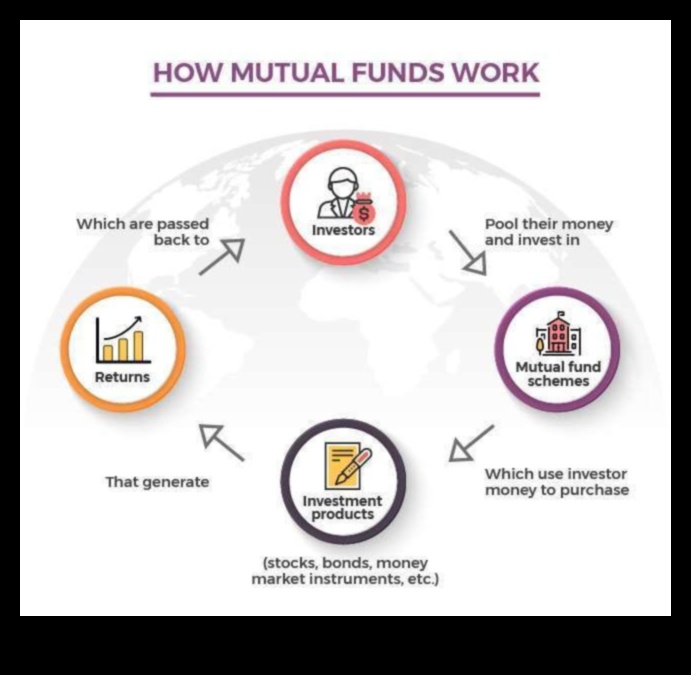

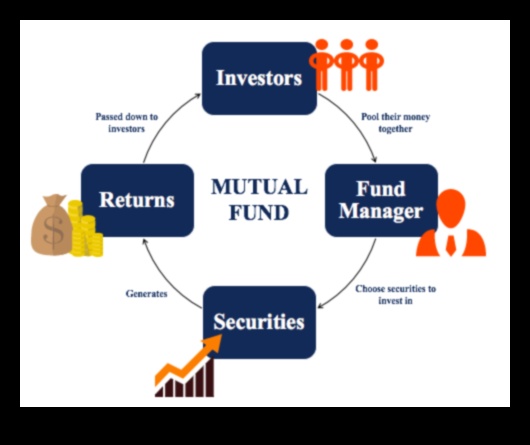

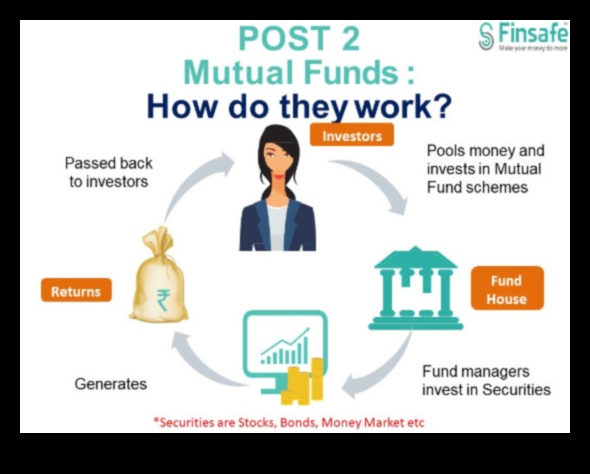

II. How do mutual funds work?

A mutual fund is a type of investment fund that pools money from investors and invests it in a variety of stocks, bonds, and other securities. Mutual funds are often used by investors who want to diversify their portfolios and who do not have the time or expertise to manage their own investments.

Mutual funds are typically managed by a professional investment manager who is responsible for selecting the investments that the fund will hold. The manager will also make decisions about when to buy and sell investments, and how much to charge in fees.

Mutual funds can be classified into different types based on their investment objectives, their investment strategies, and the fees they charge. Some of the most common types of mutual funds include:

- Stock funds invest in stocks

- Bond funds invest in bonds

- Money market funds invest in short-term debt securities

- Index funds track the performance of a particular index

- Target-date funds invest in a mix of stocks and bonds and are designed to meet the needs of investors at different stages of their lives

Mutual funds can be a good investment for investors who are looking for a diversified and professionally managed investment. However, it is important to understand the different types of mutual funds and the risks and rewards associated with each type before investing.

How do mutual funds work?

A mutual fund is a type of investment fund that pools money from investors and invests it in a variety of stocks, bonds, and other securities. Mutual funds are often used by investors who want to diversify their portfolios and reduce risk.

Mutual funds are typically managed by professional investment managers who use a variety of strategies to select investments for the fund. These strategies can vary depending on the type of mutual fund, but they all aim to achieve the fund’s investment objective.

Mutual funds offer a number of advantages over investing in individual stocks or bonds. These advantages include:

- Diversification: By investing in a mutual fund, you can spread your risk across a variety of investments, which can help to reduce the volatility of your portfolio.

- Professional management: Mutual funds are managed by professional investment managers who have the experience and expertise to select investments that are likely to perform well.

- Convenience: Mutual funds are easy to invest in and trade. You can typically buy and sell shares of a mutual fund through a brokerage firm or directly from the fund company.

However, there are also some disadvantages to investing in mutual funds. These disadvantages include:

- Costs: Mutual funds typically have higher fees than investing in individual stocks or bonds. These fees can include management fees, sales charges, and other expenses.

- Taxes: Mutual funds are taxed at the same rate as ordinary income, which can be higher than the tax rate on capital gains.

- Liquidity: Mutual funds may not be as liquid as individual stocks or bonds. This means that it may take longer to sell your shares of a mutual fund if you need to access your money quickly.

Overall, mutual funds can be a good investment option for investors who want to diversify their portfolios and reduce risk. However, it is important to understand the advantages and disadvantages of mutual funds before investing.

II. How do mutual funds work?

Mutual funds are a type of investment vehicle that pool money from investors and invest it in a diversified portfolio of stocks, bonds, and other securities. This diversification helps to reduce risk and can provide investors with a potential for higher returns than they would achieve by investing in individual stocks or bonds.

Mutual funds are typically managed by professional investment managers who are responsible for selecting the investments that make up the fund’s portfolio. Mutual funds can be classified into different types based on their investment objectives, such as growth funds, income funds, and balanced funds.

Mutual funds can be purchased through a broker or directly from the fund company. The minimum investment required to purchase a mutual fund varies from fund to fund, but it is typically between $100 and $1,000.

Mutual funds offer a number of advantages over other investment vehicles, including:

- Diversification

- Professional management

- Convenience

- Tax efficiency

However, mutual funds also have some disadvantages, including:

- Fees

- Risk

- Volatility

Overall, mutual funds can be a good investment option for investors who are looking for a diversified, professionally managed investment that is relatively easy to purchase and maintain.

V. How to invest in a mutual fund?

To invest in a mutual fund, you can either open an account with a brokerage firm or use a robo-advisor.

Once you have an account, you can choose the mutual fund you want to invest in. You can do this by looking at the fund’s prospectus, which contains information about the fund’s investment objective, fees, and performance history.

Once you have chosen a mutual fund, you can invest by making a lump-sum purchase or by investing on a regular basis.

When you make a lump-sum purchase, you invest a single amount of money all at once. This is a good option if you have a large amount of money to invest and you are not concerned about market timing.

If you are investing on a regular basis, you can invest a set amount of money each month or quarter. This is a good option if you are saving for a long-term goal, such as retirement, and you are not concerned about market timing.

Once you have invested in a mutual fund, you can track your investment by looking at the fund’s net asset value (NAV). The NAV is the price of one share of the fund, and it is calculated by dividing the fund’s assets by the number of shares outstanding.

You can also track your investment by looking at the fund’s performance. The fund’s performance is measured by its annualized return, which is the average annual return the fund has earned over a period of time.

II. How do mutual funds work?

Mutual funds are investment vehicles that pool money from investors and invest it in a diversified portfolio of stocks, bonds, and other securities. This diversification helps to reduce risk, and it can also make it easier for investors to invest in a variety of assets that they might not otherwise be able to afford.

Mutual funds are typically managed by professional investment managers, who are responsible for making investment decisions on behalf of the fund’s shareholders. Mutual funds can be either actively managed or passively managed. Actively managed funds are managed by managers who try to outperform the market by picking stocks and bonds that they believe will outperform the overall market. Passively managed funds, on the other hand, are managed by managers who try to track the performance of a specific index, such as the S&P 500.

Mutual funds offer a number of advantages over other investment vehicles, including:

- Diversification

- Professional management

- Convenience

- Tax efficiency

However, mutual funds also have some disadvantages, including:

- Management fees

- Taxes

- Liquidity

Overall, mutual funds can be a good investment option for investors who are looking for a diversified, professionally managed investment that is relatively convenient and tax-efficient. However, it is important to understand the risks and rewards of investing in mutual funds before making a decision.

VII. The risks of investing in mutual funds

There are a number of risks associated with investing in mutual funds, including:

- Market risk: The value of a mutual fund can go down as well as up, and you could lose money if you sell your shares when the market is down.

- Interest rate risk: If interest rates rise, the value of bonds in a mutual fund will decline, which could cause the value of the fund to go down.

- Credit risk: If a company that a mutual fund invests in goes bankrupt, the fund could lose money.

- Liquidity risk: Mutual funds may not be able to sell their investments quickly, which could make it difficult for you to sell your shares if you need to do so.

- Tax risk: The taxes you pay on your mutual fund investments can vary depending on how you hold them and when you sell them.

It is important to be aware of these risks before you invest in a mutual fund. By understanding the risks, you can make informed decisions about which funds to invest in and how to manage your risk.

VIII. How to manage your mutual fund investments?

Managing your mutual fund investments can be a daunting task, but it is important to stay on top of your investments in order to make sure that you are getting the most out of them. Here are a few tips for managing your mutual fund investments:

-

Set goals for your investments. What do you want to achieve with your investments? Are you saving for retirement? A down payment on a house? A child’s education? Once you know your goals, you can start to make investment decisions that are aligned with those goals.

-

Rebalance your portfolio regularly. As the market changes, so should your portfolio. By rebalancing your portfolio, you can ensure that your investments are still aligned with your goals and risk tolerance.

-

Don’t panic during market downturns. It is normal for the stock market to go through periods of volatility. If the market does take a downturn, don’t panic and sell your investments. This is usually the worst time to sell, as you will likely lock in your losses.

-

Be patient. Investing in mutual funds is a long-term game. It takes time for your investments to grow. Don’t expect to get rich overnight.

By following these tips, you can help to manage your mutual fund investments and make sure that you are getting the most out of them.

IX. How to tax your mutual fund investments?

When you invest in a mutual fund, you are not taxed on your investment gains until you sell your shares. This is in contrast to stocks, which are taxed on a quarterly basis. However, there are some exceptions to this rule, such as when you sell shares of a mutual fund within 60 days of buying them. In this case, you will be taxed on any gains as if you had sold the stocks themselves.

In addition, mutual funds may also be subject to capital gains distributions, which are taxed as ordinary income. These distributions occur when a mutual fund sells some of its holdings and distributes the proceeds to its shareholders. The amount of the distribution is based on the fund’s net investment income, which is calculated by subtracting expenses from investment income.

The tax treatment of mutual fund investments can be complex, so it is important to consult with a tax advisor to understand how your specific investments will be taxed.

FAQ

Q: What is a mutual fund?

A: A mutual fund is a type of investment fund that pools money from investors and invests it in a variety of stocks, bonds, and other securities.

Q: How do mutual funds work?

A: Mutual funds work by dividing their assets into shares, which are then sold to investors. The fund manager uses the money from these sales to purchase investments on behalf of the fund’s shareholders.

Q: What are the different types of mutual funds?

A: There are many different types of mutual funds, each with its own investment objective and risk profile. Some of the most common types of mutual funds include:

* Stock funds

* Bond funds

* Balanced funds

* Index funds

* Target-date funds